Does that mean that I am opposed to any new levy?

No. In fact, I voted in favor of the resolution to put a 6.9 mill Permanent Operating Levy on the May ballot, and voted YES on Issue #7 in this month's election.

As we all know, Issue #7 was defeated in an election in which fewer people bothered to vote than we have students in our school district. That doesn't mean the situation is resolved. We have, as a community, allowed the annual spending of our school district to grow well beyond our funding - a situation which is further exacerbated by significant cut backs in State funding. Barring unforeseen circumstances, I am confident that there will be a levy on the November ballot. The only questions are the size of the levy, and what gets cut if the levy issue fails.

Levy math is pretty simple. In our school district, we will raise about $2.2 million per year for each new mill of property tax. Last year, 1 mill would have raised $2.4 million/yr, but we are now operating on the assumption that the Franklin County Auditor will be reducing property valuations by about 8% in our community. This means that we now need about 1.09 mills to raise the same amount of money as 1 mill raised last year.

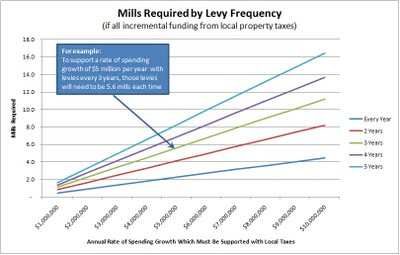

As I described in "Budget Knobs," another parameter we need to decide is how often we want to be asking for more money. To cover any particular rate of spending increase, the frequency in which new levies are enacted is inversely related to the size of the levy that will be needed. In plain English, the more often a levy is passed, the smaller it can be each time, given any particular rate of spending growth.

For visual folks like me, I thought a chart which shows this relationship might be helpful:

|

| click to enlarge |

The traditional approach is to determine all the new ways in which we're going to spend more money, then propose a levy of whatever size the Board thinks the public will tolerate, and then come back to the community again when that new level of funding is no longer enough.

How about if we go at this from the opposite direction?

What if we decide how often we are willing to let our property taxes increase, and by how much, and use that to determine the rate in which our spending can grow?

Isn't that more like the way we budget in our own households? After all, we don't make up a wish list of all the stuff we want, then go in to our boss' office and say "I've determined all the things I want to do and have, and you're going to have to commit to giving me a 10% raise every two years to support it!"

Don't we instead try to make some reasonably conservative projections of future income, and adjust our wants and desires to fit within that projected income stream?

Not everyone did of course, instead choosing to finance their unsustainable level of wants and desires by borrowing from credit cards and from the equity on their homes. The current economic situation in our country is caused largely by that behavior.

We've done a little of that in our school district as well. We didn't borrow money for daily operations - the law does not permit borrowing to fund current operations unless a school district has been declared to be in Fiscal Emergency by the State. But we did allow our spending to grow in excess of our revenue, in part by using one-time Federal stimulus money to fund current operations, and in part by emptying our rainy day fund.

Back to levies.

Now that we have this chart in our mind, is it as simple as saying "I'm willing to see my taxes go up by 5 mills every 3 years?" Unfortunately - no. There is also a structural reality we need to need to come to grips with: Compensation and benefits - which are approaching 90% of our spending - tend to rise exponentially, rather than linearly. This is what I mean:

Let's say a person is paid $10,000/yr, just to keep the math simple. Let's also say that the person has an employment contract specifying that the person will receive a 10% salary increase at the beginning of each year for three years. Since 10% of $10,000 is $1,000, that means the increase is $1,000 in the first year, making the new salary $11,000. What about year 2?

If the contract had specified that the person would receive a $1,000 raise each year, then the year 2 salary would be $12,000. But the contract said that the increase would be 10%. That means the raise would be $1,100 (10% of $11,000), and the new salary would be $12,100. The following year the salary would be $13,310. Graphically, it looks like this:

I wrote an article last July called "Teacher Salary History" which describes the compensation structure used in the current agreement with the teachers' union, the Hilliard Education Association. As I described, the two main components of that structure are the year to year base pay increases, and the step increases granted to teachers in years 0-15, 20 and 23 of their careers. Mathematically, this structure could be represented as follows:

Back to levies.

Now that we have this chart in our mind, is it as simple as saying "I'm willing to see my taxes go up by 5 mills every 3 years?" Unfortunately - no. There is also a structural reality we need to need to come to grips with: Compensation and benefits - which are approaching 90% of our spending - tend to rise exponentially, rather than linearly. This is what I mean:

Let's say a person is paid $10,000/yr, just to keep the math simple. Let's also say that the person has an employment contract specifying that the person will receive a 10% salary increase at the beginning of each year for three years. Since 10% of $10,000 is $1,000, that means the increase is $1,000 in the first year, making the new salary $11,000. What about year 2?

If the contract had specified that the person would receive a $1,000 raise each year, then the year 2 salary would be $12,000. But the contract said that the increase would be 10%. That means the raise would be $1,100 (10% of $11,000), and the new salary would be $12,100. The following year the salary would be $13,310. Graphically, it looks like this:

I wrote an article last July called "Teacher Salary History" which describes the compensation structure used in the current agreement with the teachers' union, the Hilliard Education Association. As I described, the two main components of that structure are the year to year base pay increases, and the step increases granted to teachers in years 0-15, 20 and 23 of their careers. Mathematically, this structure could be represented as follows:

f(n) = C((1+s)(1+b))n

Where:n = the number of years into the future for which pay is being calculated

C = the current salary for a teacher

s = the step increase factor, which is 4.15% in the current contract

b = the base pay increase factor, which was 3% for 2008-2010

So if our labor agreements cause compensation costs to rise exponentially, then it would seem that we need to come up with a revenue plan which grows exponentially as well.

As it turns out, this is exactly what we've been doing over the past 35 years. Except that it's not just the size of the levies which have been increasing, it's also been the frequency:

So what now - levies every two years? How long before we get to levies every year?

As it turns out, this is exactly what we've been doing over the past 35 years. Except that it's not just the size of the levies which have been increasing, it's also been the frequency:

|

| click to enlarge |

Maybe we need to think about a different approach altogether.

Many people believe the Ohio Supreme Court said property taxes are unconstitutional. That lawsuit - Derolph v. State of Ohio claimed that the State funding was insufficient, causing school districts with low property values to either tax themselves excessively, or have underfunded schools. In fact, in one of it's many opinions on this case, the Court noted that property taxes are the most stable means to fund schools.

Governments which are dependent on income taxes for revenue are hurting deeply these days, from local towns to the State of Ohio. Conversely, school districts which depend on property taxes - which is our case - have not taken any significant revenue hits in The Great Recession.

For many years, school leaders - especially those in affluent districts like ours - have complained that a law enacted in the 70s, commonly called "HB920" prevents property taxes from rising automatically with property values, and that this is the reason school districts had to keep coming back to the voters for more and more levies. As is often true with political statements, this one has some truth to it, but it's not the whole picture.

You see, HB920 also prevents property taxes from going down when real estate values tumble, as has happened in the past few years. So when you receive your new property value determination from the Franklin County Auditor later this summer, you'll probably see that the value of your home has been set about 8% lower than it was before. But that won't mean that your property taxes will decrease.

And it means the school district won't have to deal with a loss in local revenue.

And it means the school district won't have to deal with a loss in local revenue.

So here is our structural problem: The thing which drives our spending is compensation and benefits, and it rises exponentially. Our local revenue stream - upon which we will increasingly depend for additional funding - is very stable, but changes only upon passage of a new property tax levy. For our property tax revenue stream to grow exponentially, levy issues have to passed in exponentially larger sizes (not likely), and/or the frequency of levy issues has to increase exponentially (what's more frequent than every year?).

However, there is another tool available to us: Ohio law permits communities to impose school income taxes. Approximately 30% of all school districts in Ohio currently impose income taxes, collecting from a low of $3.01 per student in Zane Trace Local Schools (Ross County) to $3,091/student in Oberlin City Schools (Lorain County). For those districts with school income taxes, the average and median income tax collected per student is about $1,000.

It should be noted that districts with high school income tax rates, like Oberlin, tend to have much lower property tax rates. The high dependence on school income taxes would expose them to the same revenue risks as municipal government, although it should be noted that Oberlin is a community built around a college, which tends to make incomes more stable.

One more point deserving mention: Ohio law allows school districts to base income taxes on all income, just 'earned income' or a combination of both. The option of 'earned income' taxes came about to allow school districts to excuse those who have little or no earned income, notably senior citizens who tend to be living on pensions, retirements savings and Social Security (disclosure: I'm one of these people, so an earned income tax would be very beneficial to me). Politically, these levies tend to be much easier to pass, as senior citizens are much more likely to vote than the general population, and earned income taxes are an easy sell to them.

So is there a place for school income taxes in our school district?

PROS:

It should be noted that districts with high school income tax rates, like Oberlin, tend to have much lower property tax rates. The high dependence on school income taxes would expose them to the same revenue risks as municipal government, although it should be noted that Oberlin is a community built around a college, which tends to make incomes more stable.

One more point deserving mention: Ohio law allows school districts to base income taxes on all income, just 'earned income' or a combination of both. The option of 'earned income' taxes came about to allow school districts to excuse those who have little or no earned income, notably senior citizens who tend to be living on pensions, retirements savings and Social Security (disclosure: I'm one of these people, so an earned income tax would be very beneficial to me). Politically, these levies tend to be much easier to pass, as senior citizens are much more likely to vote than the general population, and earned income taxes are an easy sell to them.

So is there a place for school income taxes in our school district?

PROS:

- Since nearly all of our tax dollars are used to pay for the salaries and benefits of our district's employees, if we can negotiate labor agreements which are coupled to community income, a revenue stream derived from community income should automatically track funding needs, and significantly reduce if not eliminate the need for future property tax levies.

- Likewise, if our incomes go down, the amount of tax we have to pay diminishes as well. We can't be 'taxed out of our homes' in this case. But it means it is crucial that the labor agreements with the school employees have automatic adjustment clauses that reduce compensation commensurate with the revenue loss. Otherwise the loss of revenue will require layoffs to bring the spending back into alignment with the reduced revenue flow.

CONS:

- When our incomes go up, the amount of school taxes collected will increase correspondingly, without the need for a property tax levy vote (school leaders typically view this as a PRO).

- Without the need for a property tax levy vote, there will be a diminished need for the School Board and Administration to be accountable to the community. I personally like that we have that accountability today.

I'm beginning to think that a mixture of property tax levies and income taxes might be the best way to go. We would pass property tax levies of a reasonable size (e.g. 3 - 4 mills) every 5 years or so to provide a stable funding base. On top of that base, we would use income taxes to provide a revenue stream which changes with the state of the local economy.

The fiscal strategy we've been using for many years to operate our school districts just isn't going to work going forward. The compensation mechanism is no longer compatible with the funding realities. We need to look at new structures for both.

And we're running out of time to act.

Paul - I'm sorry, but I find it rather disingenuous that you would promote an income tax. Seriously? it has bad optics (to use your words)

ReplyDeleteABM: Most of what I'm saying is that the same old strategy doesn't make sense any more. But I don't understand you calling me disingenuous - any time I've brought up property taxes, I've disclosed that I am personally at the state of life whether either a straight income tax or an earned income tax would be better for me that more property taxes. So no hidden agenda. Furthermore, I think it's perfectly reasonable for me to be a spokesperson for the thousands of people in our community in the same situation.

ReplyDeleteOne of the complaints about income taxes, which I failed to mention, is that they are imposed on residents only - not businesses. Since 25% of our district's total property value is in commercial property, it costs home owners 25% less to raise $X with property taxes, while an income tax would put the full burden on residents, but not businesses.

No revenue option available to school districts is perfect. But we have to agree that if we intend to be able to give our teachers, staff and administrators reasonable raises over their careers, we'll always be in the business of passing levies, whether property tax or income tax.

Income tax does not solve the underlying problem of unsustainable expense growth.

ReplyDeletePaul, sometimes I think in an effort to spark debate and build consensus, you put forth options that you don't like.

But this community needs a leader....

A school district income tax would be paid only by the residents of the district and not the non-resident employees that work within the district. Correct?

ReplyDeleteOne of the skills a good leader needs to develop is knowing when to make autocratic decisions, when it is better to evoke discussion before making a decision, and when the decision can be left up to the team. There a cool approach called the Vroom-Yetton-Jago model, which was developed to help leaders decide which of these decision modes is most appropriate given the state of several conditions.

ReplyDeleteHere's a website that walks you through the model.

My interpretation of the situation suggests that this the leadership needs to seek input from the community before making a decision. That's what I'm attempting to do.

Relative to income taxes: They can be a very efficient and effective way to align revenue to spending, provided we can somehow tie the comp structure to revenue. That is, we develop a way to "index" compensation to revenue, so that when revenue goes up, it is automatically shared with employees. Likewise, when revenue diminishes - as can happen in a general economic downturn - then compensation is automatically adjusted downward as well.

PL

Heatherdu - I believe that is incorrect, which is one reason I am not in favor of funding schools through this method. I'm pretty sure it is just like a city income tax - you are taxed if you work in the city, doesn't matter where you live. And you don't get a vote in it either.

ReplyDeleteHeather: That's correct. A school income tax is the complement of a municipal income tax, the latter which is paid by individuals whose place of employment is in the municipality, but residents (unless the resident both lives and works in the municipality).

ReplyDeleteWhile property values and incomes are positively correlated (ie people with expensive property tend to have high incomes), incomes are more volatile. But since we pay our property taxes from our income flow, the "pain factor" associated with property taxes vary.

It just seems to me that there is some sense in a revenue structure where say 90% of the need is funded through a stable source like property taxes, but the marginal funding comes from a variable source like income taxes - again provided the employee comp structure is designed to be sensitive to community income changes.

Hillirdite: As I answered Heather, a school income tax is imposed only on the residents of the district, regardless of where they work - the inverse of municipal taxes.

ReplyDeleteConsequently, a school income tax issue is voted on by the same folks who would have to pay the tax if the issue passes.

I stand corrected. Guess I was confusing this with property taxes and the fact that I pay far more to Columbus for a business property than I do to Hilliard, yet don't get a vote regarding it.

ReplyDeleteTry selling a $300k+ home in Hilliard. And then a year later, when it is still on the market, you will understand why additional taxes are not the answer for this community.

ReplyDeleteT... I appreciate what you are saying. But I can also tell you a story about a good friend who has his home on the market, got a reasonable offer, but had the offer withdrawn when the levy failed. A buyer looks for many things, including the health of the school district.

ReplyDeleteI think it is possible to both keep our schools in high regard, and moderate the pace of tax growth. But it will take a well-informed and engaged community to pull it off.

Paul, I like your point of indexing compensation to revenue.

ReplyDeleteGet this in the contract and then we can start talking about additional mills or income taxes. We need some assurance that we won't just be out of money again in two years.

This is a good deal for everyone. Teachers are protected b/c revenues dont decrease. And the community gets to pay what it can afford.

T... we still have to answer the question about what to do about the fact that current spending is more than current revenue. Without a levy, there will have to be cuts. There's really only two knobs to turn if we don't get a levy passed:

ReplyDelete1. Programming (ie the number of people employed)

2. Average compensation per employee

Neither can be dialed back without consequences, and often those consequences aren't fully comprehended when the decision is made. That's the reason we need a lot of folks thinking about this stuff.

I think we have substantial problems that no one is addressing.

ReplyDeletePaul, HB920 has a caveat that prohibits a levy's effective millage from collecting more than what the voters approved. This is why the district was in reality expecting 8% less revenue from the failed levy than it was targeted to bring in because of the 8% drop in values.

But the 2008 6.9mil levy is also being collected at 6.9 mils right now; and USAToday just had an article this morning saying that property values are down to 2002 levels. This means that the tax collected by the 2008 levy will drop also, and possibly even the 2004 levy as well.

I'm not sure about the bond issue in 2006, but it could also be affected.

So, not only do we have out of control spending, we have contracting revenue as well. And yet this isn't even being talked about.

It also doesn't appear that the economy is turning around anytime soon, especially on the jobs side.

I hate to say it, but I don't see how the district comes through this without major cuts, so I think all the conversations about levies and income taxes are pointless at this point in time.

Well, my first question would be, "What is the minimum head count we could have while still preserving our curriculum".

ReplyDeleteI have little doubt that we could identify inefficiecies in how the curriculum is set up. Correcting them would allow us to operate at the same level, but on a reduced head-count.

However, to identify such ineffeciencies requires a great deal of access and detailed knowledge. Usually it requires the perspective of someone independent of the process.

Although the audit & accountability committee provided us with some great opinions at the "macro-level", that should not have been their task. Macro-level course setting is the responsibility of the Board (assuming its members are qualified).

If the Audit & Accountability Committee were properly tasked with finding efficiency solutions, maybe they could become more relevant in the negotiations.

I won't claim to be an expert on HB920, but I'd be very surprised if it allows the per-parcel, "outside millage" collection on levies in force to change, up or down.

ReplyDeleteCertainly the "inside millage" portion (4.45 mills) of our revenue will change with property valuations, and Treasurer Brian Wilson has factored this into the Five Year Forecast. But the impact is less than 1% of operating revenue from local property taxes.

T... agreed, I think that is indeed one of the questions we'll need to tackle.

ReplyDeleteExcellent post Paul, I feel like I've learned more about the situation. Love the charts. And a brave post, given the lack of enthusiasm for new taxes.

ReplyDeleteReally going to be hard to sell until compensation gets under control - administrators are wildly overpaid and teachers on average 10-20% overpaid.

If this process (of getting compensation in line with average hourly wage of public sector folks) happens across all school districts, which I think it mostly will (didn't even Dublin's union make concessions recently?) then we won't hurt the quality of education vis-a-vis other districts.

Paul,

ReplyDeleteIt will effect collection on levies in force because as property values drop, the effective millage goes up, but it cannot exceed the actual millage.

Which means if values continue to drop, eventually the effective millage will return to the original millage. Since the 2008 levy's effective millage IS the original millage, it will reduce the amount collected on that levy.

And the further they drop (and remember, some people are predicting another 25-40% drop in value), the more likely a previous levy will be effected by the HB920 caveat.

The only good thing is that properties are essentially valued (for tax purposes) at 2005 levels, because there was no adjustment in 2008. So any drop is likely to be small at this point.

Re HB20 - I don't think there's any online document of the actual HB920 as passed (it was around 35 years ago), so I have to guess which sections of the current Ohio Revised Code are a vestige of HB920.

ReplyDeleteI'm thinking ORC 5705.199, and that (A)(2) might be the operative language.

Not being a lawyer, I won't swear that I'm reading this accurately, but it seems like this is saying that once a levy is passed, that in the subsequent years, the amount collected is (a) the same dollar amount as the previous year PLUS (b) the total new property value since the prior year times the effective millage used the prior year. provided this amount calculated under (A)(2)(b) is not less than zero.

Since the term derived from (A)(2)(b) can't be negative, doesn't that make it sound like the number of dollars collected year to year on a levy can't go down?

Maybe there's language somewhere else that has the effect you describe. Can your source guide us to that?

"Really going to be hard to sell until compensation gets under control - administrators are wildly overpaid and teachers on average 10-20% overpaid.

ReplyDeleteIf this process (of getting compensation in line with average hourly wage of public sector folks) happens across all school districts, which I think it mostly will (didn't even Dublin's union make concessions recently?) then we won't hurt the quality of education vis-a-vis other districts."

Wildly overpaid administrators? Teachers overpaid 10-20%?? Wow..I'd like to know where you get your stats on this comment??

In line with average hourly public workers? Do you mean those who are required by the state to be highly educated(masters degree eventually) and licensed?

As for as concessions, you will see concessions very soon. More than most any district in the area, including Dublin. Of course, I am sure that won't be enough for "some" who think teachers should be paid min wage. Wow...

Yes Anonymous June 2 9:25PM, Fall Sports and Most gifted programs will be saved due to self-imposed teacher compensation growth reduction and increases to medical contribution. I'm sure a levy, much smaller than 6.9 will still be necessary in the fall, but there will be a 30 month reduction in growth for 90% of the budget. I am happy about this news and believe it buys us time to figure it all out. The Board has done NOTHING and the administration done NOTHING.... at least the greedy teachers did something about the problem. It's not a fix, but it is certainly one leg of the stool. Community and Administration: Ball is in your court.

ReplyDeleteAnon 11:10 - the sports and gifted programs cost far less than the money that will be raised by a 6.9 mil levy; those programs were merely the leverage used to try to pass it in May. There is almost no way that a smaller than 6.9 mil levy would even be considered for November as it would just not make economic sense - the 5 Year Forecast, based on current trends, shows that. As far HOW the restored programs were saved, I think it is a bit premature to start patting teachers on the back for any type of "self-imposed" reductions in compensation growth or increased contributions. I am not aware that any contract has been reached - in fact I am not even aware of any current negotiations. I am hopeful, due to what I see happening around central Ohio. Regardless of whether we think teachers deserve more ( and I am one who feels many do) we have to stay within a budget and choices have to be made based on voter acceptance. It is becoming more and more clear what that level of voter acceptance is.

ReplyDeleteHillirdite: A new tentative agreement has indeed been reached with both unions, and will be voted on by the Board Monday night.

ReplyDeleteI think it's a good and fair deal, and appreciate the actions of the teachers and staff to help recalibrate our spending to the current economic situation.

There is still much more to do. More to come...

Hilliardite, not premature at all. Just because you aren't aware doesn't mean it isn't happening. I wouldn't put speculation on this board. And yes, I said a levy will still be necessary so no need to correct me. And given the reduction in growth as a result of the union concessions, a new 5 year forecast is required to identify the new revenue gaps. The required levy size will be less without question. However, other factors such as desired span between levies, loss of income from state, etc. may prompt the board to keep 6.9 on the ballot, but it won't be for the same reasons as the one in May. A lesson in all of this is don't assume teachers, board, and administration aren't working to reduce spending. Obviously the union has been talking for several months about how to go about this. But in your defense, how would anyone know? The district as a whole has a major communication and PR issue. And IMO that starts at the top.

ReplyDeleteI am not a teacher, but feel that are often vilified on this board. Fact is they have signed up for almost 3.5 years worth os cost control (1 year extension last year plus this 30 agreement). They deserve some positive recognition for that.

I received the e-mail shortly after posting that. I too appreciate it!

ReplyDeleteAnon at 2:20 - the "reason" for the 6.9 mil levy in May was that was the figure that the Board felt had the highest likelihood of passing. And sorry if I was premature regarding the upcoming contracts - see my above post. I have spent the last 4 years, both on this blog and elsewhere, saying that while many teachers do indeed deserve higher pay, staff compensation MUST be based on the money available. Short-changing students at the expense of the past contracts with 7.15% annual raises for 70% of teachers just didn't make sense to me. Ideally that part is behind us and we can now address the rest of the fiscal problems in our district, as this was just one piece of the "pie".

ReplyDeleteI would also add that had this contract been announced prior to the levy vote in May, there is little doubt in my mind that it would have passed. It certainly would have received my vote.

ReplyDeletePaul, I am very grateful that successful negotiations have occurred and that something fair and reasonable to all parties was able to be found. I am especially pleased that gifted K-5 and Fall Middle School sports are being reinstated. Out of curiosity though, any idea why the two gifted courses for middle school (6th grade Focus LA and 7th grade Compacted Science) were not reinstated?

ReplyDeleteHillirdite, I agree. Not sure it would have changed 1000 voter's minds but it would have made it closer for sure.

ReplyDeleteI am very interested in the new 5 year forecast. Paul, any idea when that might be published. Any word on what the administration did to curb their compensation packages?

I understand that teachers and administrators made concession on compensation, however, the same levy on the ballot again this November? Our property tax grows from 4000+ dollars to 6500 dollars in the last 6 years. And we are expecting a new levy every two year? We did not vote this May but count us, our whole family will put a firm NO this November!

ReplyDelete